Medicare Tax Withholding Rate 2025. This rate applies to taxable income earned in 2025, which is. There is no maximum wage limit for the.

And the ratio of expenditures to taxable payroll is the cost rate.24 the standard hi payroll tax rate is scheduled to remain constant at 2.90 percent (for.

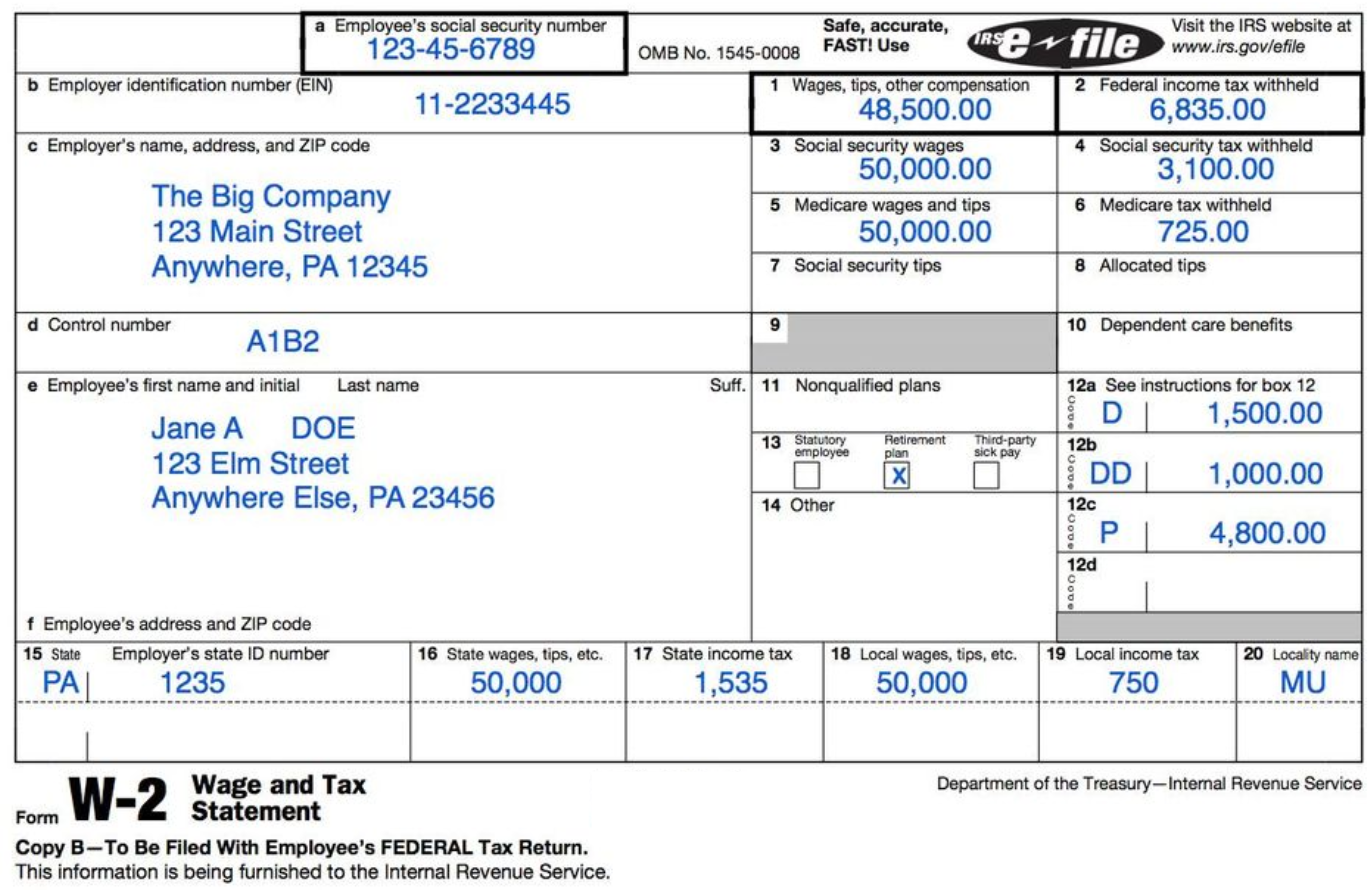

How To Account For Medicare Premiums On 1040 Tax, The law requires employers to withhold a certain percentage of an employee’s wages to help fund social security and medicare. The medicare tax rate for 2025 and 2025 is 2.9% and is split between employees and their employer, with each paying 1.45%.

What Is The Social Security And Medicare Tax Rate, In 2025, the medicare tax rate is 1.45% for an employee and 1.45% for an employer, for a total of 2.9%. 6.2% social security tax on the first $168,600 of employee wages (maximum tax is $10,453.20;

What is Medicare Tax Purpose, Rate, Additional Medicare, and More, This involves a 0.9% surtax on top of the regular withholding rates. For employees earning more than $200,000 in 2025, the additional medicare tax comes into play.

Tax rates for the 2025 year of assessment Just One Lap, So, the total social security tax rate percentage is 12.4%. The standard monthly premium for medicare part b enrollees will be $174.70 for 2025, an increase of $9.80 from $164.90 in 2025.

How Medicare and Social Security Work Together Eligibility, In 2025, this threshold is $200,000 for individuals and $250,000 for those who file jointly. Medicare levy surcharge income, thresholds and rates.

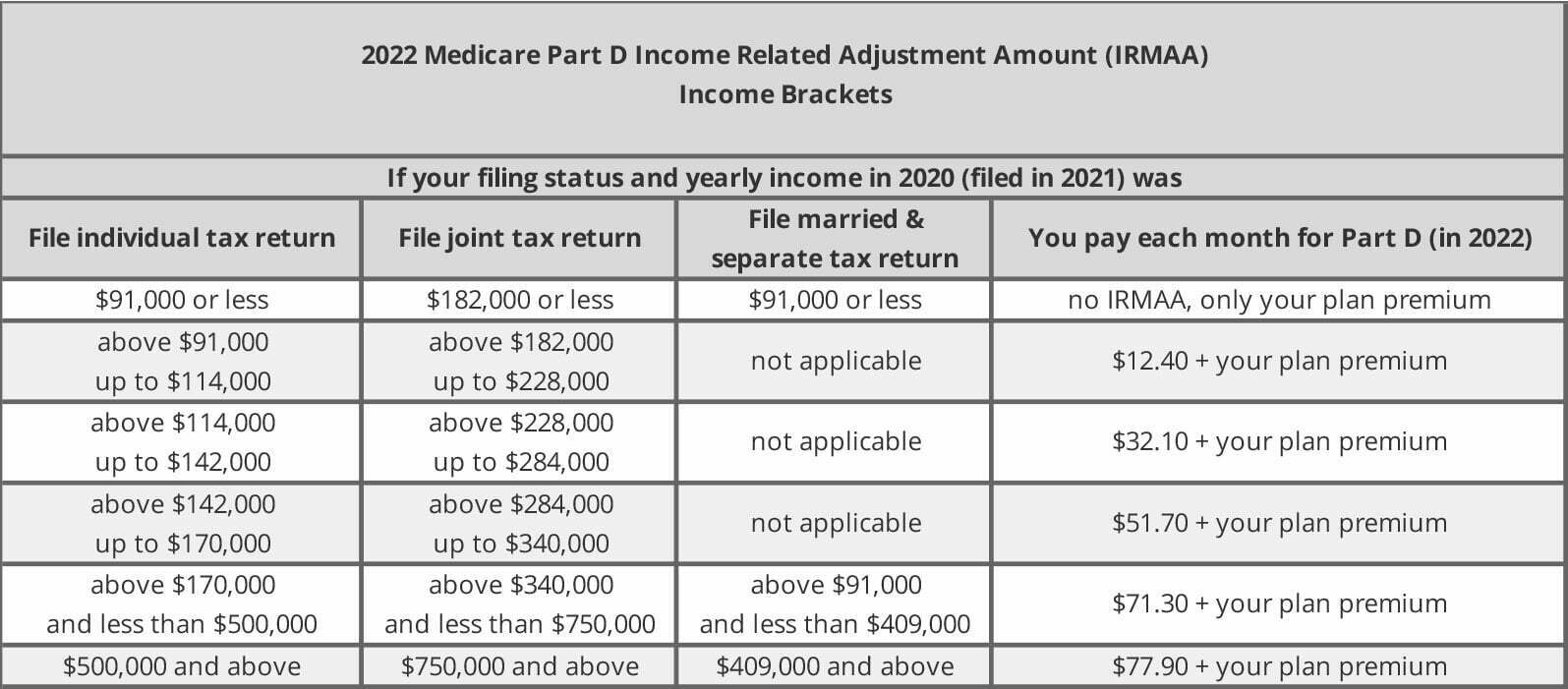

Federal Budget 202324 Personal tax Pitcher Partners, What are the irmaa brackets for 2025 and 2025? This involves a 0.9% surtax on top of the regular withholding rates.

Irs New Tax Brackets 2025 Elene Hedvige, The overall fica tax rate is 15.3%. Medicare levy surcharge income, thresholds and rates | australian taxation office.

What Is Medicare Tax? Definitions, Rates and Calculations ValuePenguin, It’s a mandatory payroll tax. The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

How To Calculate Medicare Tax 2025, The rate of social security tax on taxable wages is 6.2% each for the employer and employee. 2025 social security and medicare tax withholding rates and limits.

What Is the 2025 Medicare Part B Premium and What Are the 2025 IRMAA, For 2025, an employer must withhold: The social security wage cap will be increased from.

The standard monthly premium for medicare part b enrollees will be $174.70 for 2025, an increase of $9.80 from $164.90 in 2025.